The three most important words while investing.

High risk and high return is the idea of past. This has changed to low risk and high returns.

The margin of safety is basically the cushion that you want in an investment opportunity. We often say a lot of juice is still remaining in a particular asset/deal/business. It is nothing but an opportunity having high margin of safety. It is one of the very important concepts of Value Investing (Investing style mastered by great investor Warren Buffet)

Basically “Margin of Safety” helps in protecting the down side and acts as a cushion for a wrong investing assumption by an individual, bad luck or extreme volatility in a complex, unpredictable and rapidly changing world and thus this approach basically says “Heads I Win & Tails I don’t lose much”

“Margin of Safety” has been the most important tool used by the astute investors Warren Buffet. The real skill lies in understanding and calculating the Margin of Safety of an asset.

Price and Value are 2 different measures but often considered one. “Margin of Safety” is basically buying an asset below its intrinsic value (true worth or true value).The current price of any asset is a matter of demand and supply. If it is the “IN fashion” asset currently, the demand will be much higher than the supply, so many a times the price moves much above the intrinsic value (true worth or true value).

Benjamin Graham (Warren Buffets mentor) basically came up with the concept of “Margin of Safety”

According to him he would like to buy 1 $ (true worth or true value) at 70 cents. This would protect his downside. Implying he wants to buy an asset at 30% discount to its actual value (true worth or true value).

Warren buffet similarly uses 50% as a minimum “Margin of Safety” to buy a company. There are different ways of calculating the true value of a company. The most commonly used is DCF (discounted cash flow), and real asset (tangible assets) based method.

The discounted cash flow model takes into account a company’s free cash flow and weighted average cost of capital, which accounts for the time value of money. In asset based calculations the market value of all the tangible asset is taken to value the company.

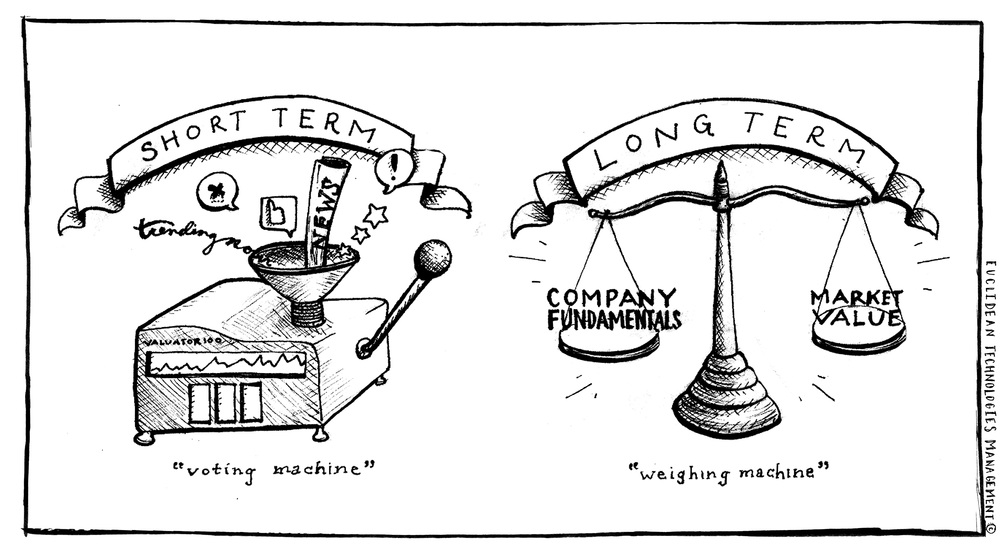

In the short term the stock markets acts like a voting machine… What the crowd feels (herd mentality approach), it is only about the price (not sustainable) and it is never about the fundamentals/ true value. But in the long run it always acts like a weighing machine finding the value (true net worth) sustainable for long term

The more the “Margin of Safety” for an asset higher could be its comfort of holding the asset and higher its allocation in the portfolio. Thus the higher the Margin of Safety the asset is in a value zone (Buy Zone) and lesser the “Margin of Safety” the asset is in the price zone (Sell Zone). Every asset moves between the value and prize

zone. So one needs to enter when asset is in value zone and exit when it’s in the price zone.

Finally, in investing protecting the down side is the key and Margin of Safety helps in the best possible way of protecting the downside.

At Simple Solutions, “Margin of Safety” has become the cornerstone of our stock/MF investing philosophy.